Do You Know: What Are Emerging Markets?

Dec 23, 2023 By Susan Kelly

Introduction

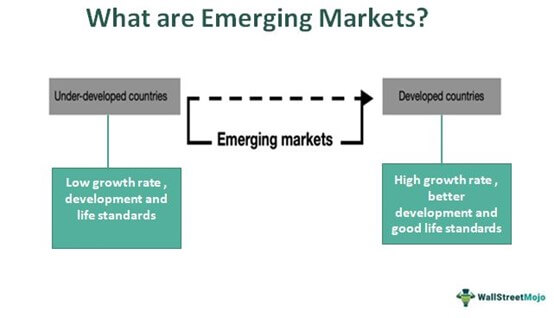

What are emerging markets? Any established framework does not define emerging markets. High per capita income, exports of a wide variety of goods and services, and increased integration into the global financial system are why the IMF considers 39 economies to be "advanced" in its World Economic Outlook. In contrast, "emerging market and developing economies" include all of the remaining nations. The IMF Fiscal Monitor classifies 40 of these as "emerging market and middle-income" economies due to their higher incomes.

Rising economies have other distinguishing features besides increasing incomes. They are more like advanced economies in revenue and participation in global trade and financial market integration. The majority have experienced substantial growth and stability, allowing them to produce higher-value goods.

Characteristics of Emerging Markets

The following are examples of standard features of emerging markets:

1. Market volatility

Volatility in the market can be attributed to several factors, including political unrest, fluctuations in commodity prices, and supply and demand shocks caused by natural disasters. It leaves investors vulnerable to market performance and currency rate fluctuations.

2. Growth and investment potential

Foreign investors are frequently drawn to emerging markets because of the high potential returns on their money. Due to a lack of domestic capital, developing nations often require a large influx of foreign capital to leap into a developed economy.

3. High rates of economic growth

The governments of emerging markets frequently adopt policies that encourage industrialization and rapid economic growth. These policies result in lower unemployment, more family disposable income, investment, and better infrastructure. However, early industrialization in developed nations like the United States, Germany, and Japan has resulted in low economic growth rates.

4. Income per capita

Due to their reliance on agriculture, emerging markets typically achieve a low-to-middle income per capita compared to other countries. The average income of a country's citizens rises in tandem with its gross domestic product (GDP) as the economy moves toward industrialization and the manufacturing sector. Average incomes that are lower serve as incentives for increased economic growth.

Cultural Behavioral Finance in Emerging Markets

This way of making financial decisions in developing countries is likely to be flawed from a psychological and cultural standpoint in how asset pricing in developing countries can be understood from the perspectives of culture and behavior.

Signs of Progress

In contrast, physical, financial infrastructure, such as banks, a stock exchange, and a unified currency, is common in emerging markets. One defining feature of emerging market economies is their gradual but steady adoption of reforms and institutions similar to those of developed nations. The economy will grow as a result of this. The focus of emerging market economies has shifted from agriculture and resource extraction to industry and manufacturing. Their governments frequently implement planned industrial and trade policies to promote economic growth and industrialization.

Benefits of Investing In Emerging Markets

Because of their potential for rapid expansion, investors are drawn to these countries. Rapid growth is possible in emerging markets because of the dramatic changes in these economies. This allows financiers to enter a market at its most dynamic development phase. High growth opportunities aren't the only thing emerging markets have to offer; they also provide a place for investors to spread their money around and reduce their overall risk. Investing in various assets and strategies can reduce your broad risk exposure. New investment opportunities arise when venturing into an emerging market, some of which may not be highly correlated with established market trends at home. Sometimes the U.S. economy will zag while an emerging market's economy will zag. The portfolio's value will be less likely to fluctuate as a result.

Risks of Emerging Markets

Many large companies may still be state-run or private, which presents risks such as political instability, domestic infrastructure issues, currency volatility, and illiquid equity. Furthermore, foreign investors may find that local stock exchanges do not provide a liquid market. Unlike developed countries, emerging markets typically lack sophisticated market and regulatory institutions. To a greater or lesser extent than in developed economies, market efficiency and strict accounting and securities regulation standards are lacking (such as those of the United States, Europe, and Japan).

Conclusion

A developing economy that is just beginning to enter the developed market is called an emerging market economy. Economies in the emerging market segment typically have a standardized currency, stock exchange, and banking system and are undergoing industrialization. Due to their rapid development, emerging market economies can give investors higher returns. As a result of their special status, they are more vulnerable to several risks. Emerging ones often copy changes implemented in developed economies.

RealCrowd Online Investment Platform Review 2024

Mar 14, 2024

In this article, discover the latest insights into RealCrowd Online Investment Platform in 2024.

Brexit Uncovered: The Real Impact and Meaning for the UK and EU

Dec 30, 2023

Discover what Brexit means and the full impact of the U.K. leaving the European Union. Get the facts and uncover the truth.

2024 biBERK Business Insurance: Assessing the Pros and Cons

Jan 29, 2024

Review and analysis of biBERK Business Insurance: its benefits, drawbacks, industries covered, and customer feedback. Ideal for small to medium-sized businesses.

Do You Know: What Are Emerging Markets?

Dec 23, 2023

The term "emerging markets" describes countries experiencing rapid economic growth while exhibiting some but not all of the features of a developed economy. Countries in the process of leaping from the "developing" to the "developed" stages of economic development are known as "emerging markets."

Everything You Need to Know About Charles Schwab Loans

Mar 20, 2024

Explore borrowing options with Charles Schwab loans. Discover financial services tailored to your needs for personal and business endeavors.

Why Agritech Stocks are a Wise Investment Choice Today

Jan 19, 2024

Learn the untapped potential of Agritech stocks and why they are a wise investment for the future. Also, get an insight into the top stocks that elevate your portfolio.

Real Estate in Missouri – All You Need to Know About the Closing Costs

Mar 20, 2024

Learn about closing costs in Missouri, essential for home buying. Understand the expenses involved in budgeting effectively.

The Maxed Out Credit Card Conundrum

Oct 08, 2023

Curious about the consequences of having a maxed out credit card? Learn about the ups and downs of maxing out your card and how to avoid financial pitfalls.

Decoding Pet Insurance: Navigating the Terrain of Pre-Existing Conditions

Jan 18, 2024

Explore pet insurance: does it cover pre-existing conditions? Unravel the mystery with our guide to secure the coverage your furry friend deserves

Can You Give Someone Else Your Mortgage?

Nov 18, 2023

Mortgage transfers occur when the present holder of a mortgage (a loan used to acquire property, often a residence, using the property as security) transfers their interest in the mortgage to another party. To avoid default and foreclosure, homeowners unable to keep up with their mortgage payments may apply for a transfer.

What You Need to Know About the Belk Credit Card and How to Apply for It

Oct 06, 2023

Become an elite shopper with a Belk credit card. You can use it to earn rewards, enjoy discounts, and shop smarter.

What Is a Pension?

Dec 02, 2023

If you have a pension plan, you have ensured that you will have a consistent income once you reach retirement age. You may consider a pension to be a safe investment.